In the dynamic world of international trade, navigating the complexities of transactions can be daunting. However, with the right financial tools and knowledge, businesses can unlock endless opportunities for growth and success. One such essential tool is the Letter of Credit (LC), a vital component in facilitating secure and efficient trade transactions across borders.

What is a Letter of Credit ?

Picture this: a buyer in one corner of the world seeks goods from a seller in another, amidst a maze of regulations, currencies, and risks. Here steps in the Letter of Credit—a beacon of trust and assurance in the tumultuous sea of global transactions. Acting as a shield of protection for both buyer and seller, an LC serves as a contractual promise from a bank to make payment to the seller upon meeting specific terms and conditions.

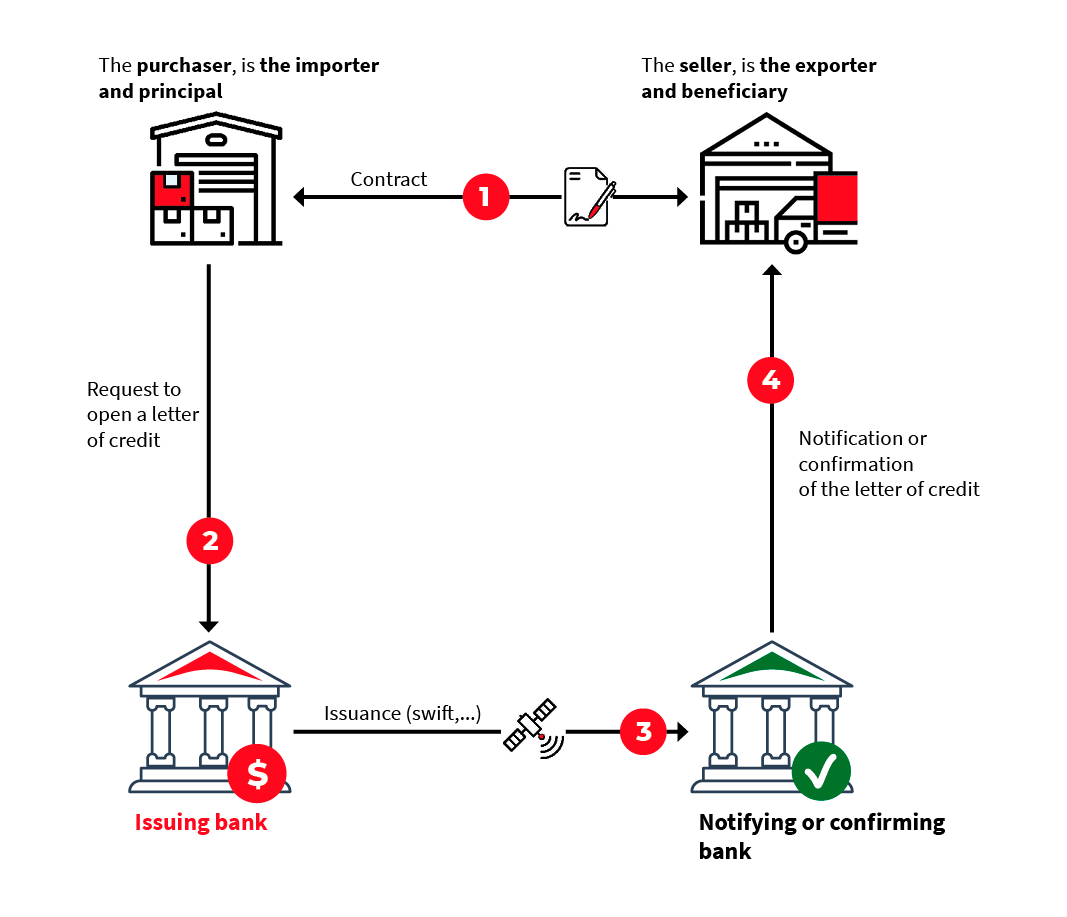

The Procedure of Letters of Credit :

The process of utilizing Letters of Credit involves several key steps:

-

- Initiation: The buyer initiates the LC process, outlining the transaction details and requirements to their bank.

-

- Issuance: With due diligence, the bank issues the LC to the seller, delineating the terms, payment conditions, and necessary documentation.

-

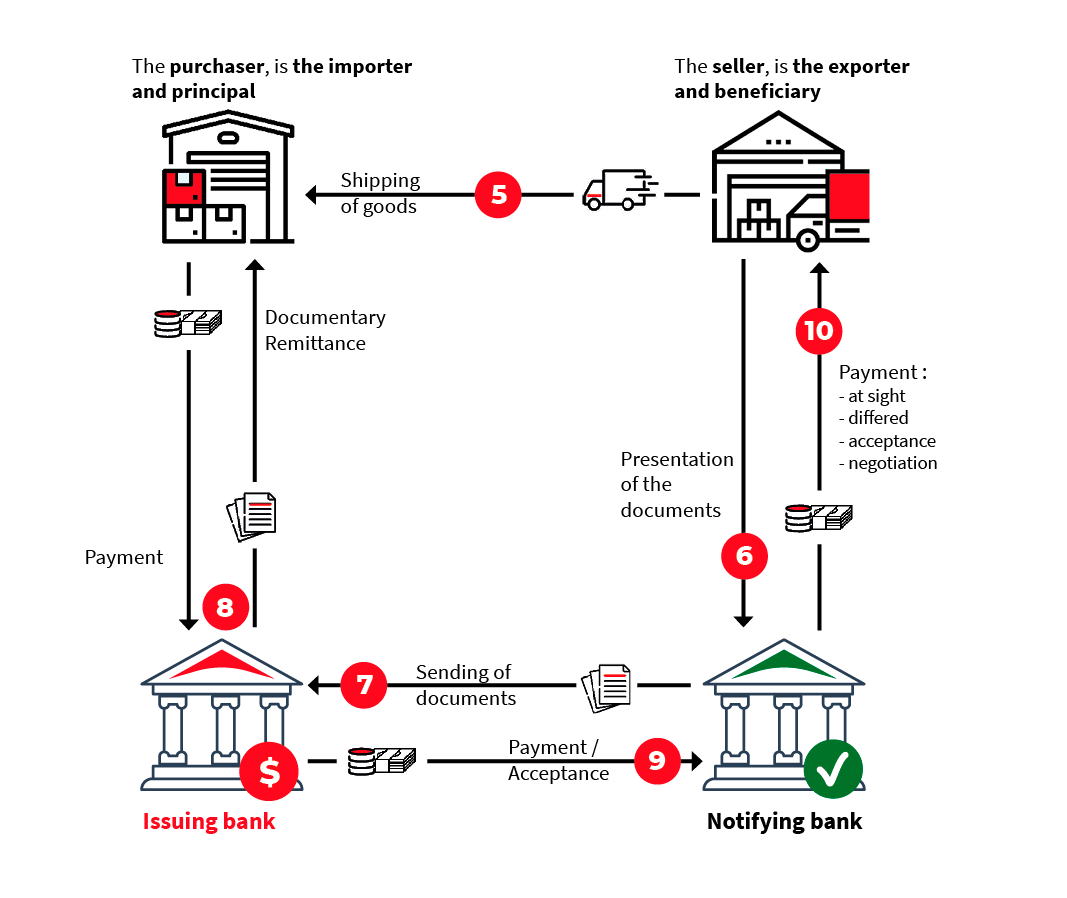

- Transaction Execution: The seller, armed with the LC, ships the goods and furnishes the requisite documents to their bank for verification.

-

- Document Inspection: The seller’s bank meticulously scrutinizes the documents to ensure compliance with the LC terms before forwarding them to the buyer’s bank.

-

- Payment Assurance: Upon satisfactory document verification, the buyer’s bank initiates payment to the seller, honoring the terms of the LC and culminating the transaction with financial finesse.

Understanding Step By Step Letters Of Credit Procedure :

Advantages of Letters of Credit in International Trades :

The use of Letters of Credit offers several advantages for businesses engaged in international trade:

-

- Payment Security: LCs provide assurance of payment to the seller, reducing the risk of non-payment or payment delays.

-

- Risk Mitigation: LCs mitigate various risks associated with international transactions, such as currency fluctuations, political instability, and buyer default.

-

- Global Acceptance: LCs are widely recognized and accepted in international trade, enhancing credibility and facilitating smoother transactions.

-

- Trade Financing: LCs can be used as collateral to secure trade financing, enabling businesses to access working capital and finance their trade activities.

-

- Flexibility: LCs offer flexibility in trade terms and conditions, allowing buyers and sellers to negotiate favorable terms and customize agreements to suit their specific needs.

In conclusion, Letters of Credit play a pivotal role in enabling secure, efficient, and risk-mitigated international trade transactions. By understanding the procedures and advantages of LCs, businesses can harness the power of this essential financial instrument to unlock new opportunities and achieve success in the global marketplace.