International trade involves inherent risks, and financial security plays a critical role in building trust between importers and exporters. Letters of Credit (LC) and Standby Letters of Credit (SBLC) are two vital tools in trade finance that help mitigate these risks. While both serve to ensure trust and financial safety, they are designed for different situations. This blog will explore what they are, when to use them, why they matter, and how to decide between the two.

What Are LC and SBLC?

-

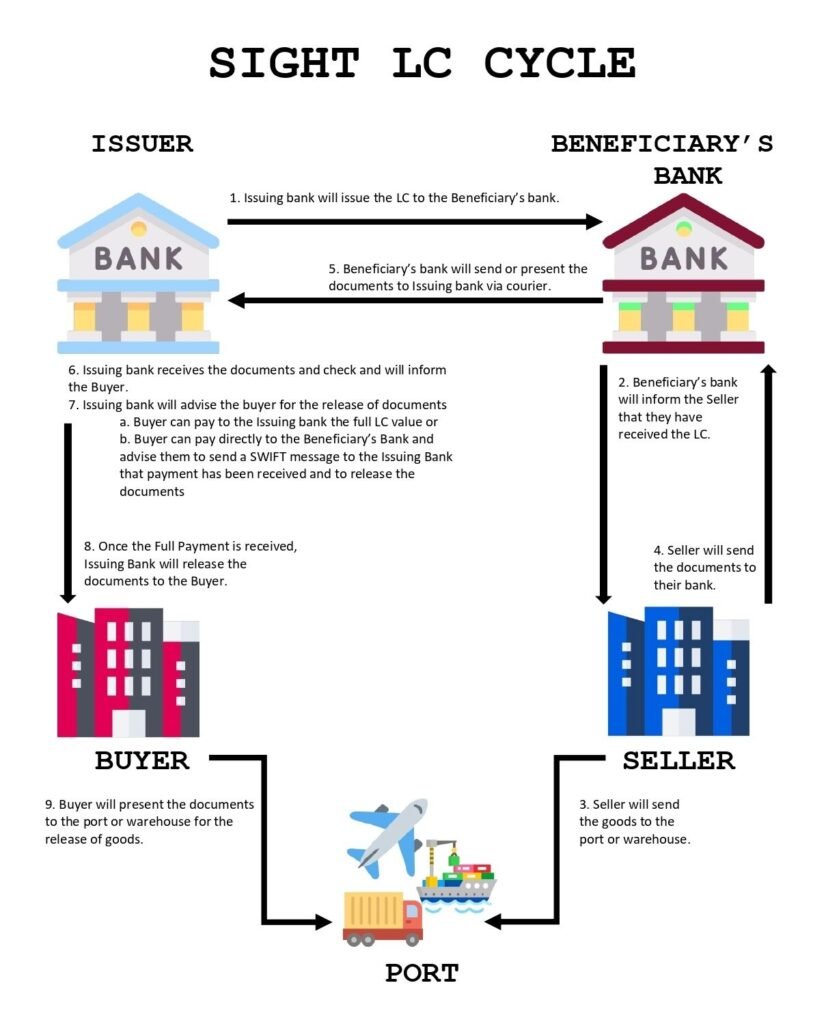

Letter of Credit (LC): An LC is a primary payment instrument issued by a bank, guaranteeing that the exporter will receive payment upon fulfilling specific terms of the trade agreement. It is widely used in global transactions to reduce payment risks.

-

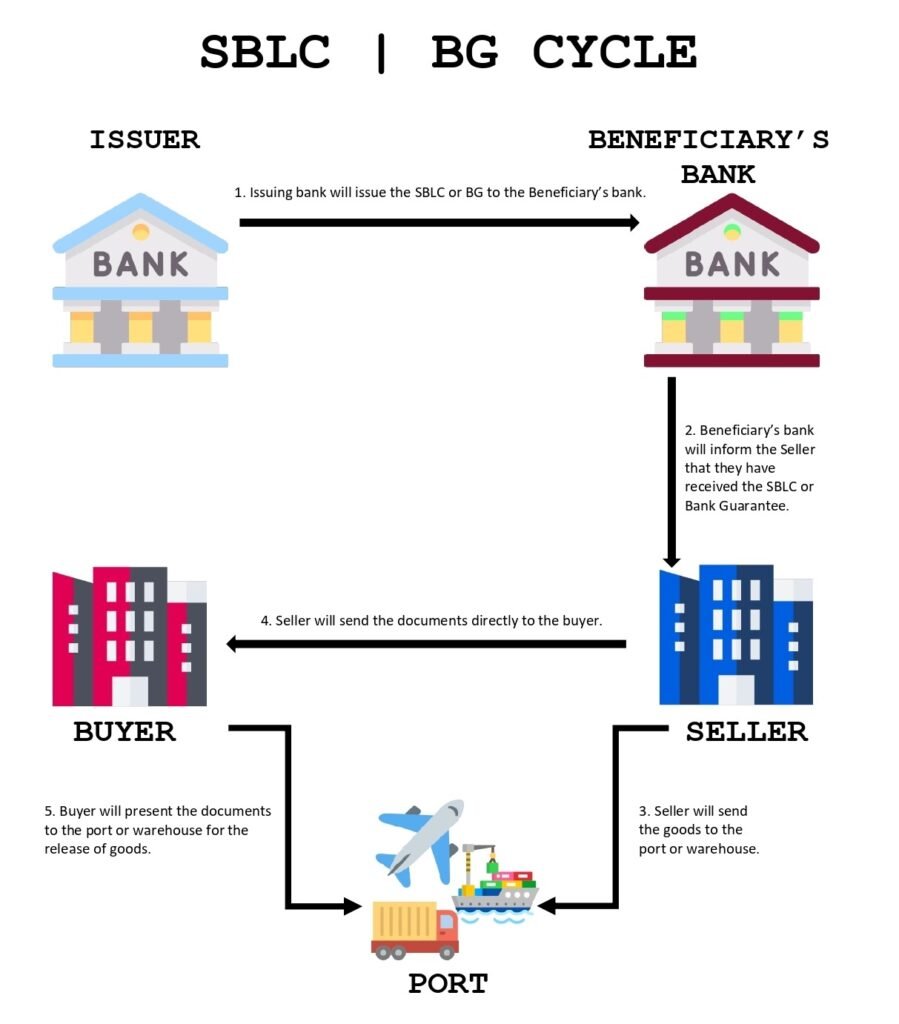

Standby Letter of Credit (SBLC): An SBLC serves as a backup payment mechanism. It assures the exporter that they will receive payment only if the importer defaults on their obligations. Unlike an LC, it acts as a safeguard rather than a primary payment method.

LC Issuance Procedure- Step By Step

SBLC Issuance Procedure- Step By Step

When Should You Use LC or SBLC?

-

Use LC When:

- Dealing with new trade partners or entering risky markets.

- Payment needs to be linked directly to performance milestones.

- Importers want assurance of receiving goods as agreed.

-

Use SBLC When:

- In large-scale or long-term projects that require performance or payment guarantees.

- The transaction involves advance payments or high-value commitments.

- Building trust in transactions with limited prior credit history.

Why Are These Instruments Important?

For Importers:

Lack of trust with suppliers or unfamiliar trade partners often demands financial assurances. LCs provide a way to pay only upon satisfaction of terms, while SBLCs offer flexibility without upfront commitments, ensuring smooth negotiations.

For Exporters:

Exporters can face non-payment risks due to buyer defaults. LCs guarantee payment on time, and SBLCs act as a fallback to secure compensation in worst-case scenarios.

Differences Between LC and SBLC

| Aspect | Letter of Credit (LC) | Standby Letter of Credit (SBLC) |

|---|---|---|

| Purpose | Primary payment tool | Backup payment tool |

| Trigger | Payment made upon fulfillment of conditions | Invoked only if the buyer defaults |

| Common Usage | Standard trade agreements | High-value projects or contracts |

| Risk Coverage | Ensures payment for goods/services | Protects against non-performance or default |

| Preferred By | Regular importers/exporters | Contractors, project financiers |

Practical Tips for Choosing the Right Instrument

- Understand Your Needs: For immediate payment assurances, choose LC. For backup financial security, SBLC is the better option.

- Evaluate the Transaction Type: Regular transactions lean towards LC, while complex or long-term projects often require SBLC.

- Consult Your Partner: Discuss with your trade partner to align on the best financial instrument for the deal.

- Work with Trusted Experts: Partner with trade finance specialists like Express Trade Finance to ensure smooth issuance and compliance.

Which One Is Right for You?

The choice between LC and SBLC boils down to your trade objectives:

- For direct, immediate payments tied to conditions, opt for LC.

- For backup assurance in long-term or high-risk situations, choose SBLC.

Final Thoughts

Both LCs and SBLCs play a pivotal role in facilitating international trade. Understanding their differences and applications ensures smoother transactions and stronger partnerships. Whether you are an importer securing goods or an exporter ensuring payment, selecting the right instrument is essential.

At Express Trade Finance, we help businesses navigate trade finance with expert guidance and tailored solutions. Let us simplify your cross-border transactions with the right financial tools.

Ready to get started? Contact us today to explore how we can support your trade journey!